A secret trove of never-before-seen IRS records reveals that many of America’s wealthiest billionaires pay zero to nearly no income tax, including Jeff Bezos, Elon Musk, Warren Buffett, George Soros, and others.

Secret IRS Records Show How Ultra-Wealthy Avoid Paying Taxes

Non-profit investigative journalism organization ProPublica uncovered a secret trove of never-before-seen IRS records, and what they found is pretty shocking. First, it shows that the wealthy truly aren’t like you and I. They are much better at avoiding paying taxes. In fact, in many cases, they don’t pay any taxes at all.

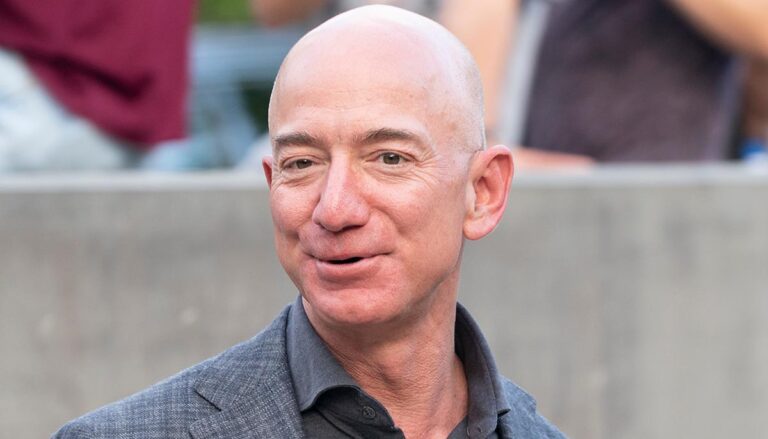

Case in point: Amazon founder Jeff Bezos, the richest man in the world, paid no federal income taxes in 2007 and 2011.

Tesla founder Elon Musk, the second-richest person in the world, also paid no federal income taxes in 2018.

They’re far from alone. George Soros paid no federal income taxes for three straight years. Billionaire investor Carl Icahn paid no income tax twice. And in recent years, also former presidential candidate Michael Bloomberg, who has a net worth of $59 billion, paid no income tax.

However, the wealthy use perfectly legal tax strategies to shrink their federal tax bills to zero or close to it.

The Taxes the Rich Pay vs. Ordinary Americans

Putting aside the years the wealthiest Americans paid little to no tax, what do they pay on average? ProPublica found that the 25 richest Americans pay an average of 15.8% of their adjusted gross income on federal income taxes. However, once you include the taxes that average Americans pay for Social Security and Medicare, the wealthy are paying less in tax than many ordinary workers are.

The average American household pays about 14% in federal taxes, and some pay more. However, there is a stark difference between the median American household that earns about $70,000 annually and what the 25 wealthiest people in America pay. When we consider their yearly profit, that’s where we get the true tax rate. For someone like Warren Buffett, that works out to 0.1% per year, or less than 10 cents for every ten dollars he adds to its wealth, ProPublica wrote.

Which Americans Are Paying the Highest Tax Rate?

People earning between $2 million and $5 million a year paid an average of 27.5%, the highest of any group of taxpayers, ABC reported. The top .001% of taxpayers–1,400 people with income above $69 million–paid 23%. However, the 25 wealthiest people paid less than all these.

President Joe Biden wants to raise the tax rate for people earning $400,000 a year or more to 39.6%. The highest tax rate for salaried and waged workers currently stands at 37%.

How Were These Records Uncovered?

With all the hoopla over getting a peek at former President Donald Trump’s tax records, one has to wonder how ProPublica came by all these private tax records. Short answer: They were leaked. Reportedly, an anonymous source delivered reams of Internal Revenue Service to ProPublica, the Chicago Tribune reported.

Are the Tax Records Accurate?

ProPublica reported that they compared the leaked data with information available from other sources.

“In every instance, we were able to check — involving tax filings by more than 50 separate people,” ProPublica wrote. “The details provided to [us] matched the information from other sources.”